Offer ends in

Financial Management Explained

$29

PDF eBook

74

Pages

1-click download

- 13 Financial Management Strategies

- Stay Ahead With Latest Trends

- Hours of Research Simplified

About Financial Management Explained

Elevate your understanding of finance with our comprehensive ebook, “Financial Management Explained.” This essential guide will equip you with the knowledge and tools needed to navigate the complex world of finance and make informed decisions that drive your organization’s success.

In this ebook, you will learn about financial statement analysis, various financial strategies, financial planning and forecasting, working capital management, and capital budgeting. You’ll also explore the cost of capital, capital structure, dividend policy, risk management, mergers and acquisitions, and international financial management.

Moreover, you’ll discover the latest trends in sustainable finance, Fintech strategies, and behavioral finance. The ebook also features practical case studies to illustrate financial management principles in action.

‘...frontrunner in delivering top-tier digital business resources...’

‘...has been making waves with its flagship product...’

‘...consistent emphasis on simplifying complex business topics...’

‘...shaping the future of digital business learning...’

‘...valuable resource in the ever-evolving world of business education...’

Table of contents

- Introduction to Financial Management

- Defining Financial Management

- Objectives of Financial Management

- The Role of Finance in Business

- Financial Statement Analysis

- The Balance Sheet

- The Income Statement

- The Cash Flow Statement

- Financial Ratios and Interpretation

- Profitability Ratios

- Liquidity Ratios

- Efficiency Ratios

- Leverage Ratios

- Market Value Ratios

- Financial Strategies

- Zero-Based Budgeting

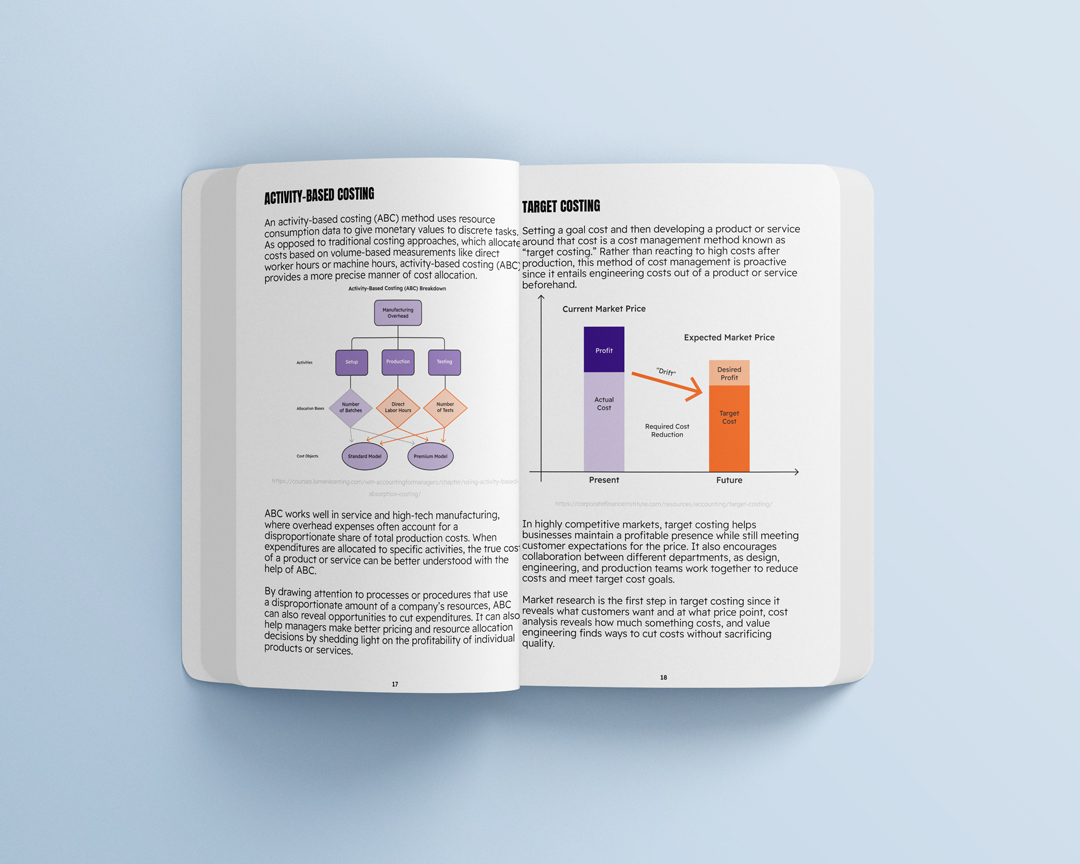

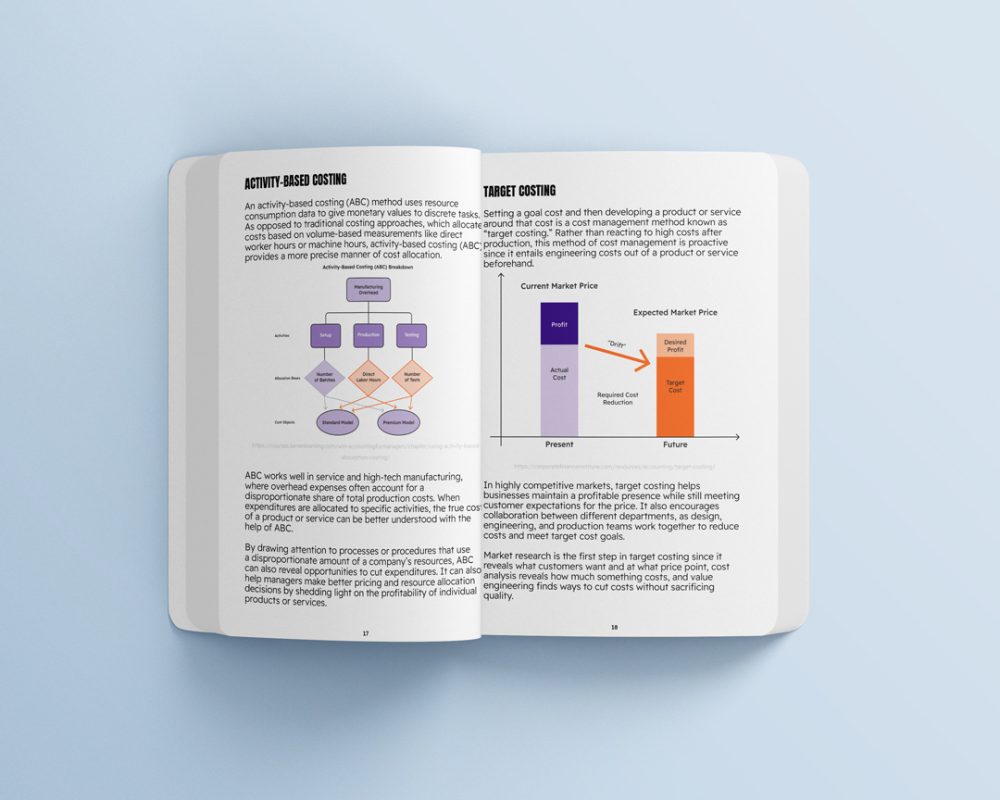

- Activity-Based Costing

- Target Costing

- Value-Based Management

- Financial Modelling

- Earnings Management

- Financial Restructuring

- Leverage Buyouts

- Financial Synergy

- Portfolio Management

- Behavioral Finance

- Sustainable Finance

- Fintech Strategies

- Financial Planning and Forecasting

- The Financial Planning Process

- Budgeting and Budgetary Control

- Financial Forecasting Techniques

- Working Capital Management

- Cash Management

- Accounts Receivable Management

- Inventory Management

- Capital Budgeting

- The Capital Budgeting Process

- Time Value of Money

- Capital Budgeting Techniques

- Risk Analysis in Capital Budgeting

- Cost of Capital

- Components of Cost of Capital

- Weighted Average Cost of Capital (WACC)

- Factors Affecting Cost of Capital

- Capital Structure

- The Concept of Capital Structure

- Optimal Capital Structure

- Theories of Capital Structure

- Financial Leverage and Leverage Ratios

- Capital Structure Decision-Making

- Dividend Policy

- The Importance of Dividend Policy

- Factors Affecting Dividend Policy

- Theories of Dividend Policy

- Dividend Policy Decision-Making

- Risk Management

- Types of Financial Risks

- Risk Identification and Measurement

- Risk Management Strategies

- The Role of Derivatives in Risk Management

- Mergers and Acquisitions

- Types of Mergers and Acquisitions

- The M&A Process

- Valuation in Mergers and Acquisitions

- International Financial Management

- Foreign Exchange Markets and Rates

- International Financial Risks

- International Financial Strategies

- Financial Management Case Studies

- Conclusion

60 Products Included

All Products Special

Order our bestselling business bundle now and save a whopping $4,269 compared to buying each product separately.

Get all 60 Products for just $197

![]() Risk-free Purchase: Full refund within 14 days

Risk-free Purchase: Full refund within 14 days

Safe Checkout Powered by

This is our LOWEST PRICE EVER - don’t miss out!

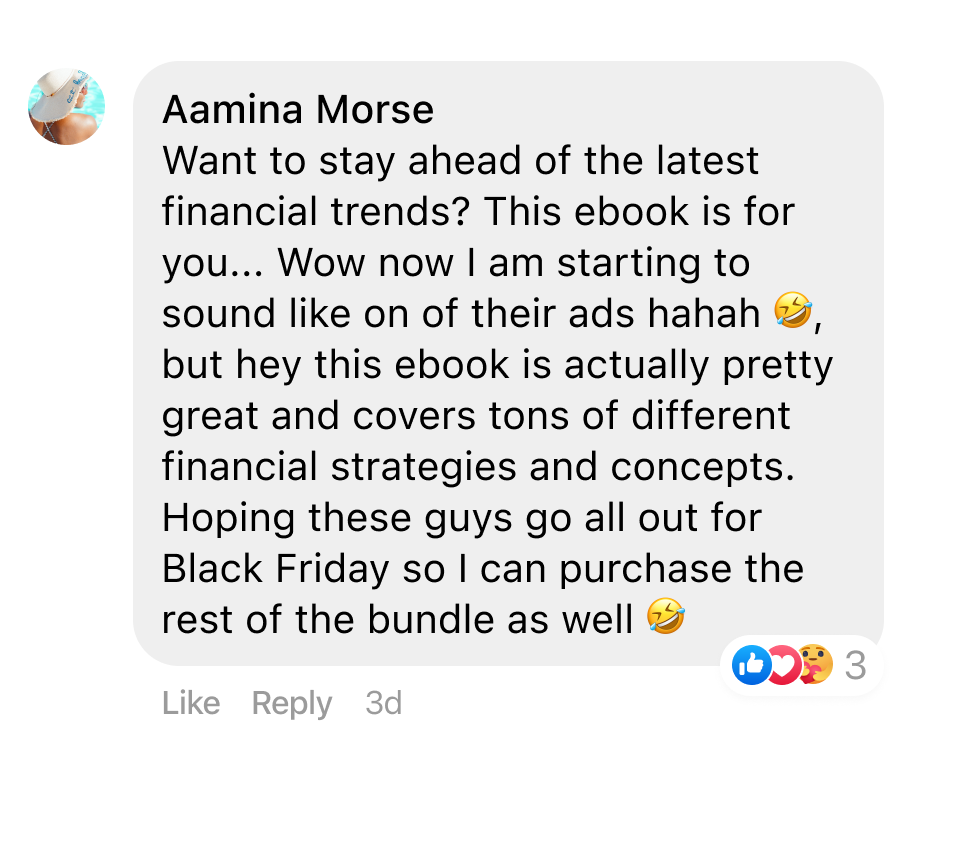

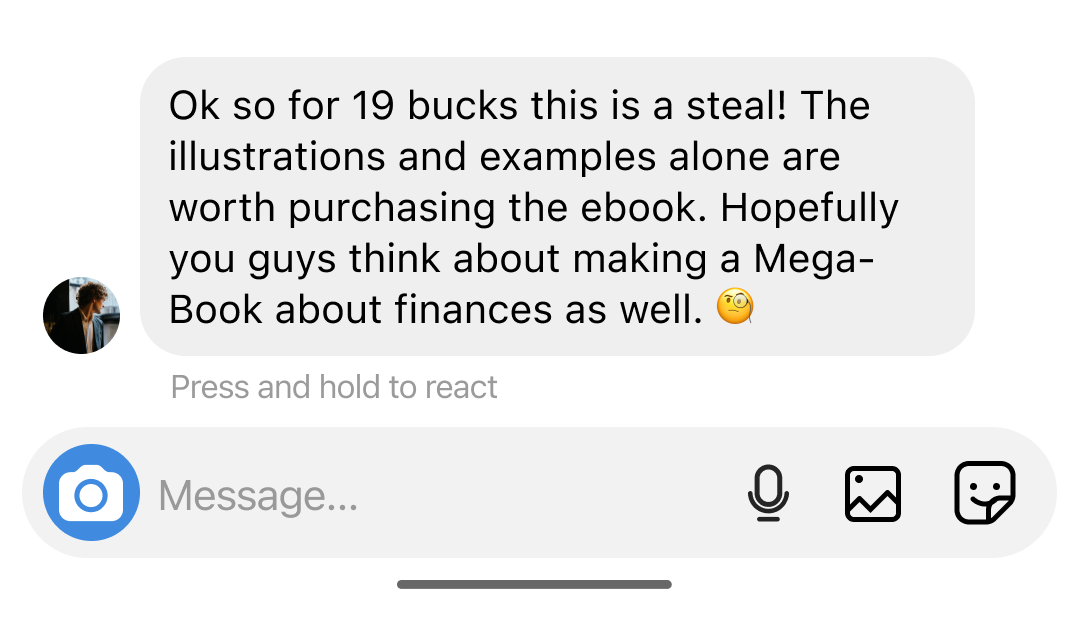

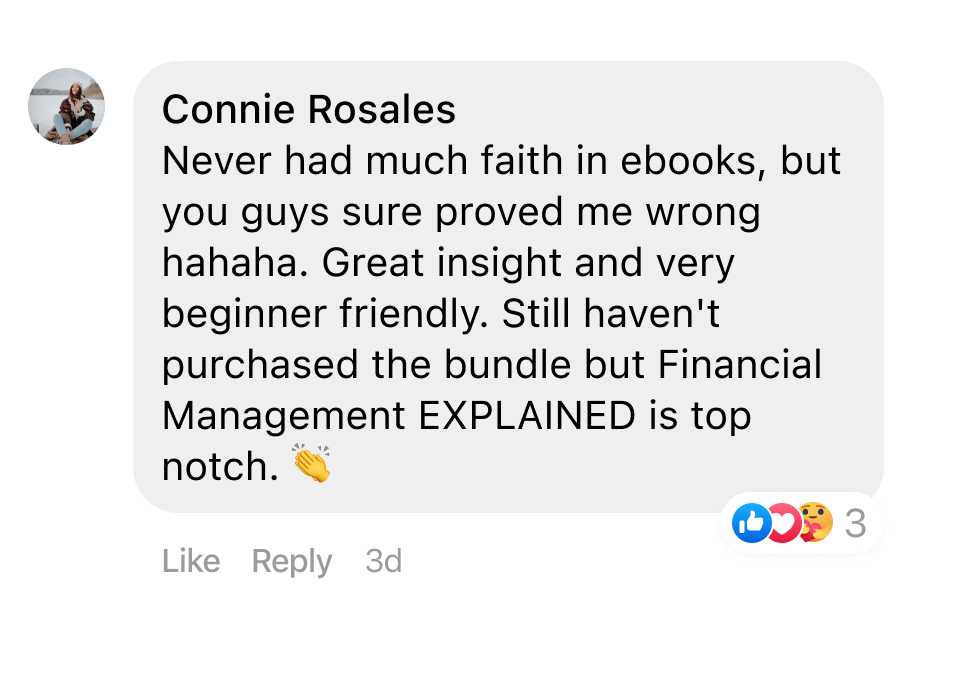

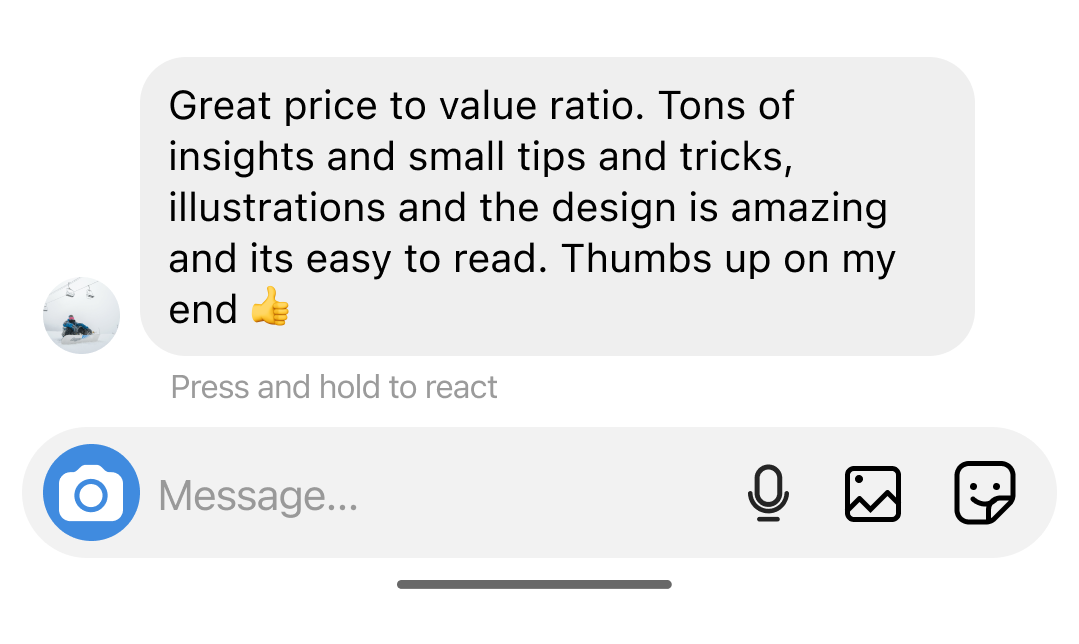

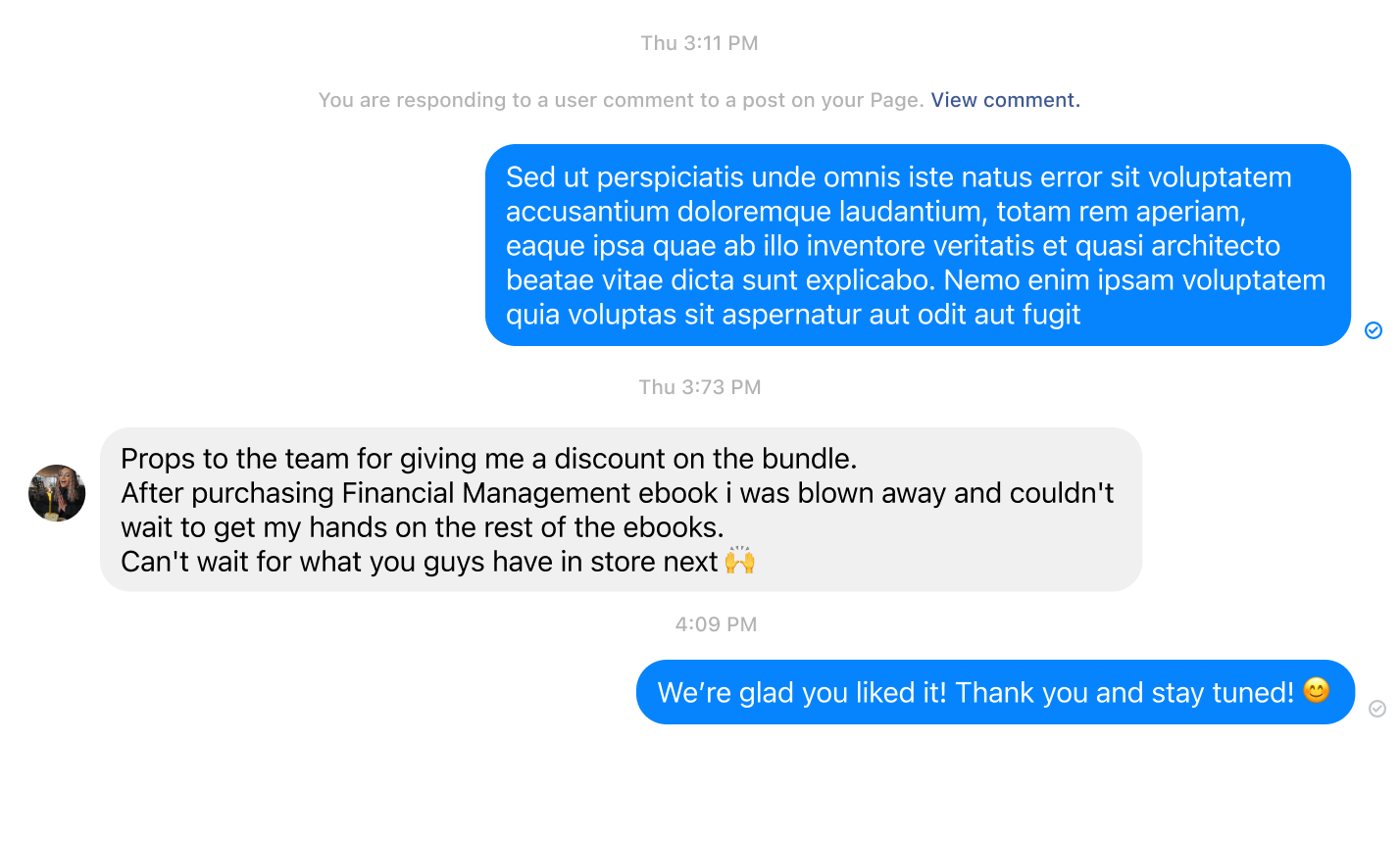

Testimonials

98.1%

Exeptional feedback from our readers

Special Offer - Lowest Price Ever

final hours

All Products Special

$197 $347

You get all 60 eBooks, Checklists and Tools!

Risk-free Purchase: Full refund within 14 days

Risk-free Purchase: Full refund within 14 days

Paddle Safe Checkout

Paddle Safe Checkout

Bundle: Success Blueprints

$129 $549

You get all 10 of our high-quality eBooks!

Risk-free Purchase: Full refund within 14 days

Risk-free Purchase: Full refund within 14 days

Paddle Safe Checkout

Paddle Safe Checkout